The only ongoing cost is the mortgage payment

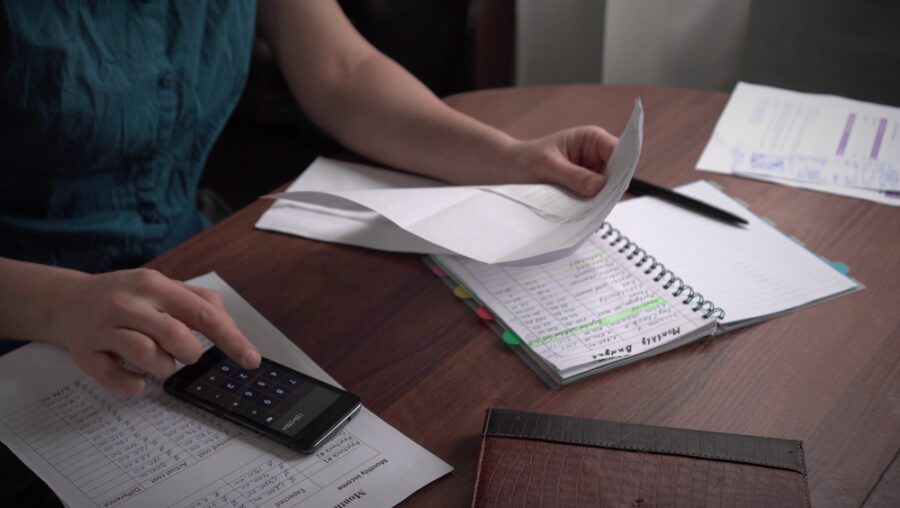

When you’re calculating your homeownership cost, you might be tricked into believing that the mortgage payment will be the main expense and that you won’t have to worry beyond that.

However, you might also encounter other unsolicited and unexpected costs, such as property taxes, homeowners insurance, repairs, and even ongoing maintenance. But if you prepare yourself to save for these costs, you’ll already cover a very important aspect of homeownership.

Why avoid any of the needed repairs or empty your credit card, when you could save for the unpredictable? Trust me, in the long run, you’ll save more money (think about the interest you might have to pay).

I want out of my mortgage. The fixed APR is fine, I am getting tired of being nickeled and dimed to death by my mortgage company. Seems like every time I turn around they are tacking on some kind of new fee.