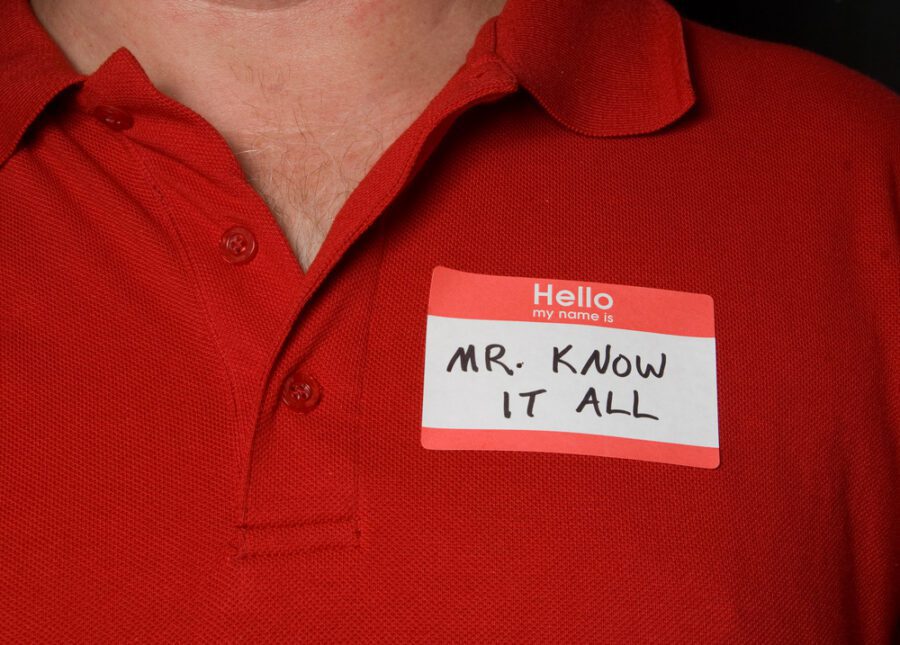

6. Thinking that you know everything

There are many retirement mistakes, but we would like you to avoid making this one because it might be the most dangerous one. Having confidence is an amazing thing, and all of us should strive to be more confident. This trait is desired by many, but there are very few who actually have it.

But having too much confidence can sometimes become a trap. Don’t you ever assume that you know everything? This is one of the worst approaches you can have in life. This world is so beautiful. Just accept that you are not the one who can possibly know everything. We, humans, are here to learn, and this is mostly what we do for our entire lives.

If you want to learn more about how you can have a fulfilling retirement, you can start with this book: Keys to a Successful Retirement: Staying Happy, Active, and Productive in Your Retired Years

You should also read: 5 Things EVERY Retiree Must Know About Nursing Homes

Thank you so much for this wonderful advicess they are very important incites for people like us the retirees. I believe people like us can benefit a lot from this very educational article. I learned a lot from this, I hope others will have the time to read it and tell many other retirees.

Yes to looking after one’s body. My doctor gives laconic advice including “Keep moving”. I know several people who use canes and walkers much earlier than they should (60s, 70s) due to aversion to exercise and long-term very sedentary lives.

My doctor: “Keep moving”. Too much love of sedentary living and aversion to simple exercise leads to early dependence on canes and walkers.

Your advice is clearly very important for a self longer life – but with respect you didn’t mention

other important personal points – in my humble view.

1 Recognise how you have not acted decently in a friend/relationship which may deserve an apology.

2 Remember a friend who is having difficulties – your remembrance will be so welcome.

3 Tell all close to you how much they have positively meant to you even if they didn’t realise it.

4 Tell Family members how much you are proud of them and that you will always Love them

I am afraid that I won’t get everything done before I die. I also want to make sure I help my kids and grandkids in any way I think will help.I want to thank people and tell them how much they meant to me. I would like to leave some money for a few charities. Leave money for my kids and grands. Be grateful and try to instill in my family the importance of kindness, tradition, and following your dreams. what else is there?