Is retiring in Florida such a good idea?

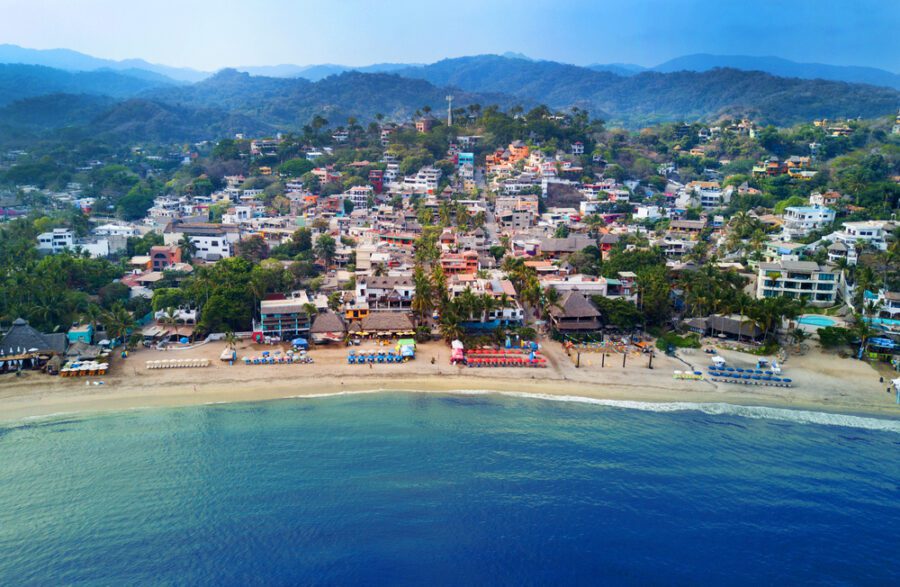

We all know by now that the most popular retirement destination in the US is Florida. From the great weather to the amazing retirement communities, there are many reasons that make retiring in Florida sound like an amazing idea, but is this all?

Before deciding to move here, I have some advice for you: try before you buy! Go there for a longer vacation and see how things really are and if the lifestyle is suitable for you.

Everyone advertises the Sunshine State as the best place for retirees, but I am here today to tell you the things about Florida that no one tells you. This is not the perfect state, and there are actually some good reasons not to want to move there. Unfortunately, not many talk about them, and this can create confusion among seniors.

So let’s see why retiring in Florida might not be the best decision. From taxes to the so-called beautiful weather, I am here to provide you with some insights about this matter.

1. All the critters

Ok, this one is already common knowledge, but Florida is the land of alligators. But this is not all. Imagine Florida as the Australia of the USA. Here, you can find the weirdest animals. And this wouldn’t be a problem if they were in the wild, but they invade the gardens!

This is not for the faint of heart, and if you plan to retire in Florida, I strongly believe that you should be aware of all of that. Once you move, you’ll need to take care of and protect your garden and yard from these wild invaders.

Herpes-carrying monkeys, Burmese pythons, and green iguanas—you can find them in the Sunshine State and also in your yard. Also, there are the rats. If you think NYC has a problem with rats, you’ve never been to Florida. Rats are everywhere! On the roof of the houses, in the palm trees, or on the beach.

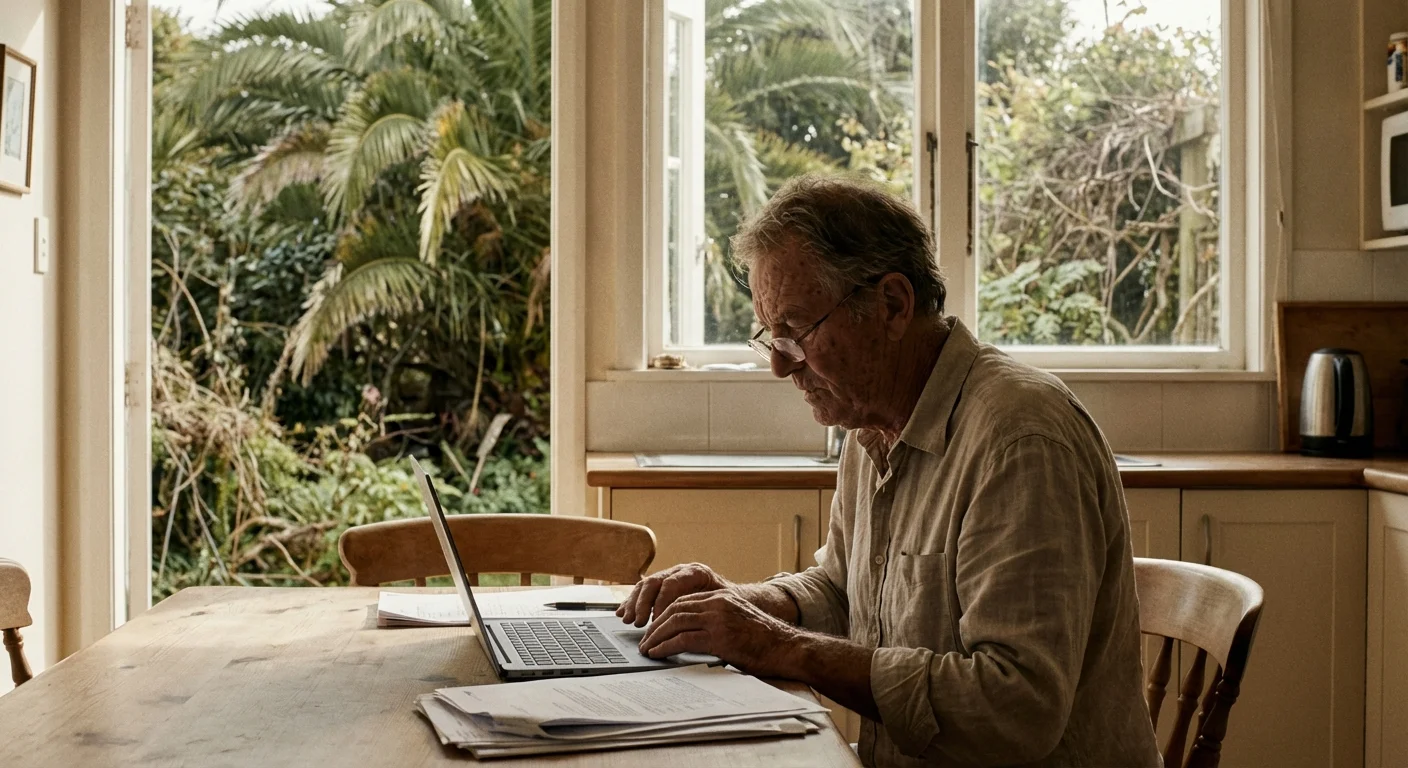

For example, when I went to Florida, I stayed with my cousin for 6 months to see if I would enjoy living there. I’ve come from Maine, and I was curious about this tropical paradise. What I wanted to say is that I was surprised to hear that she pays as much as $300 per year just to keep rats away from her house.

People who live here say that it’s not unusual for them to see snakes or iguanas on golf courses or in their gardens. This is a usual occurrence, but if you are scared of such creatures, then you might think twice before retiring in Florida.

2. No state income tax? Think again

One thing that makes many people consider retiring in Florida is the fact that there is no income state tax. Indeed, there are no taxes on Social Security benefits, pensions, and other retirement incomes. This applies once you have your residency here, and it is an amazing thing.

But no state income tax is not the same thing as no taxes at all. I was surprised to find out that Florida has some hefty state and local taxes. If you combine them, the average result is 7%, which is higher than all the combined rates of Massachusetts, Michigan, New Jersey, and Pennsylvania!

Besides this, if you decide to retire in Florida and you think about buying a new car once you move there, I have some bad news. The state sales tax, which is 6%, applies to the entire purchase price, and counties also have other vehicle sales taxes that they apply. If you want to register an out-of-state vehicle, get ready to take $225 out of your pocket.

As you can see, retiring in Florida just because you think you will have less money to pay may be a mistake. Florida makes up for that lack of state income tax, and you’ll have to pay other taxes that most people are not aware of before it’s too late and they’ve already moved there.

3. Hurricanes happen more often than you might believe

From 1 June to 30 November is the season of the Atlantic hurricane. It peaks in August through October, and the storms it causes can be quite severe, according to the National Oceanic and Atmospheric Administration (NOAA).

You’ll have endless sunshine and idyllic beaches if you decide to retire in Florida, but at the same time, there is the constant threat of hurricanes. Now, getting back to the hurricane season, there will be six months when the hurricane can strike at any time.

I was in Florida from late April until December, which means I was there during the hurricane season, and I witnessed the damages done by Hurricane Idalia, a Category 4 storm that struck Florida’s west coast in 2023.

Winds reaching 125 mph caused billions in damages. The damages are estimated at $3.6 billion! And this is just for 2023. Considering that similar events happen almost every year during hurricane season, this might not be a suitable place for those who want peace and stability.

If you are scared of potential property damage and you don’t like storms, you should think twice before retiring in Florida.

4. Hurricane insurance can be quite expensive

As you would expect, in a state that is often hit by hurricanes, you’ll want to have hurricane insurance that can cover the potential damages produced by the powerful storms.

Back home, I also have insurance for my house, and I benefit from fixed-dollar deductibles. This is not the case in Florida, where its residents have deductibles ranging from 2% to, in the worst cases, even 10% of the total coverage!

Finding affordable insurance is a true challenge, and coastal areas, particularly barrier islands, are the most affected. There are some tricks you can use that will lower the price of the insurance, but they also cost money at the beginning.

For example, my cousin and her husband managed to pay for a wind mitigation test, and their new home passed the test. Because of this, they pay a price several times lower than the standard one. But they were lucky, and not everyone who thinks about retiring in Florida is.

If you live in flood zones, things are even worse because mortgage companies require flood insurance, which is not included in the standard homeowner’s coverage. Hopefully, the law is transparent about this aspect, and you can know beforehand about this additional expense.

5. Swimming pools are expensive

The weather in Florida can be quite hot, and because of this, you might want a pool. Most people imagine that once you move here, you’ll also have a pool, but the reality is slightly different.

Installing and maintaining a pool in Florida is expensive, which is why you should think twice before purchasing one. If you plan to keep your pool running all year, you’ll need to pay around 80 to $150 per week for cleaning services. This means around $400 per month just for cleaning!

Reparation costs range from hundreds to thousands of dollars per year because leaky plumbing and torn liners are a popular occurrence in the world of pool ownership. Also, if you want your pool to be heated during the winter, you’ll need a pool heater that can cost anywhere from $1,000 to $10,000.

If you want to learn more about retiring in Florida, this book might be helpful: The Florida Domicile Handbook: Vital Information for New Florida Residents

You should also read: 10 Fun and Relaxing Summer Activities for Seniors

We moved here in 1971 from NH and have been very happy – no problems and find it so much cheaper living.

I have lived in Florida for46 years. Your description is entirely wrong. There are no rats in my area nor are the taxes as you describe. During my ownership of my residence in Florida I have also owned homes in Massachusetts and Oklahoma-both of which had far more taxes and home insurance in Oklahoma was quite expensive. By the way, my pool in Oklahoma was $400 per month plus the cost to winterize, and an additional $200-259 per month for fall leaves to be removed. In Florida I pay $150 per month.

the things outlined here is the same for many other states. All states have their ups an downs and it depends on what you want to do. I have family and friends that have been living in Florida an I have spent a great deal of time there visiting them and I have never seen any of the things mentioned here. Like any place else, there are likes and dislikes. the taxes in many cases is a lot less than most states. I would move there in spite of what is said here about Florida because I have not seen any of the things they mentions as not happening in other states. It depends on where you want to live and what you want to put up with

Exactly in what areas are you speaking about with, Herpes-carrying monkeys, Burmese pythons and all these rats? I have friends that live in all areas of Florida and none have told me about any of these creatures, especially RATS? Perhaps, there are certain Floridians bringing them in when they travel out of certain areas of Florida to keep transplants from other states from moving to Florida?? Just a thought!!

I COMPLETELY agree with you on every point! I’ve been a Florida native for 57 years and absolutely love it here! Is it hot & humid 80% of the year? Yes. But it sure beats shoveling snow :))

And NO RATS in Florida!