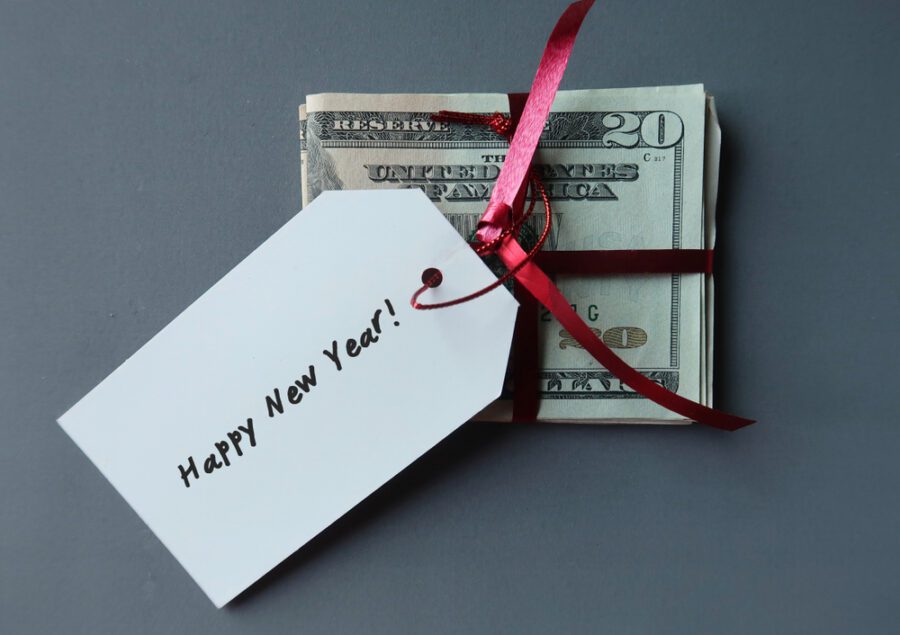

#5 Think About Postponing End-of-Year Bonuses and Payouts

It’s not always simple to request a payment delay from your employer, but if you get a bonus towards the end of the year and want to reduce your taxable income by as much as you can this year, think about requesting that they pay you in January instead of December.

Similarly to this, if you’re a freelancer or contractor looking to lower your tax liability for 2022, think about deferring the payment of your invoices until the following January. You’re only deferring paying income taxes on that sum until 2023, so you’ll need to decide whether this year or the following would be preferable for collecting that money.