Conclusion: Your Personal Expat Retirement Checklist

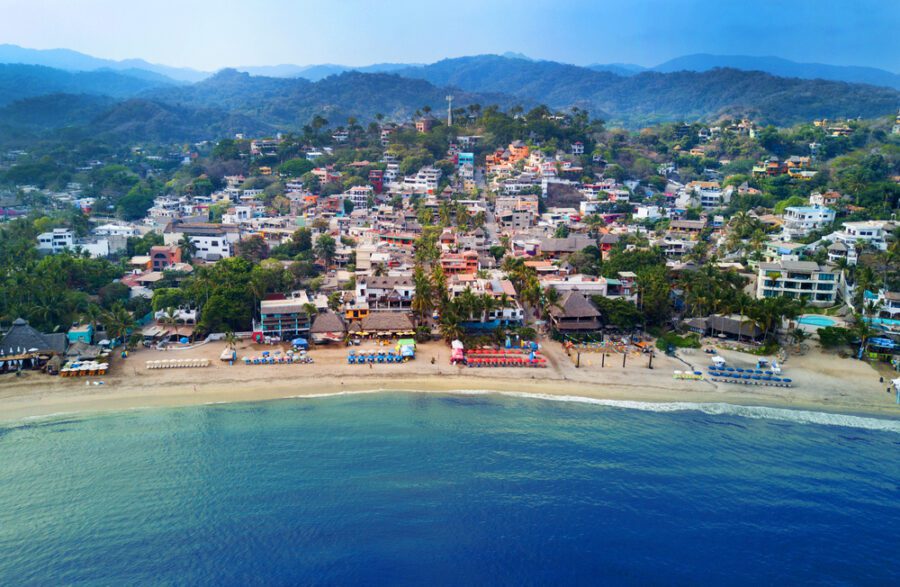

The dream of a better retirement for less is not just a fantasy; it is a real and achievable goal for many Americans. Countries like Mexico, Portugal, Panama, Costa Rica, and Spain offer compelling combinations of affordability, quality of life, and accessible healthcare. But as we have seen, this path is not for everyone. It requires courage, flexibility, and most importantly, meticulous planning.

An international retirement is a trade-off. You might trade proximity to family for a lower cost of living. You might trade the convenience of everything being in English for the richness of a new culture. The right choice depends entirely on your personal priorities, your financial situation, and your sense of adventure. The journey begins not with a plane ticket, but with honest self-reflection.

To help you move forward, here is a simple checklist to guide your first steps:

1. Define Your “Why.” Be specific. Are you seeking a lower cost of living, better weather, access to affordable healthcare, or a new cultural experience? Your primary motivation will help you narrow down your options.

2. Create a Realistic Expat Budget. Go beyond the online calculators. Research actual rental prices, utility costs, and grocery bills in the specific cities you are considering. Do not forget to budget for travel back to the U.S. and for private health insurance.

3. Research, Research, Research. Dive deep into two or three countries that appeal to you most. Focus on visa requirements, healthcare systems, and tax implications. Use resources like the AARP’s international section at AARP.org and official government immigration websites.

4. Consult the Experts. Before you make any commitments, speak with a financial advisor and a tax professional who specialize in expat issues. Their guidance can save you from making costly mistakes.

5. Plan Your “Test Drive.” This is the most crucial step. Start planning an extended visit of at least three months. This is your chance to test your assumptions and see if the reality of life in that country matches your dream.

6. Talk with Your Family. Have open and honest conversations about your desires and their feelings. Discuss how you will all work together to maintain your close bonds across the distance.

Retiring abroad is one of the biggest adventures you can undertake. It is a chance to reinvent yourself, learn a new language, and see the world from a new perspective. By approaching it with a practical mindset and a well-researched plan, you can build a retirement that is not only more affordable but also richer and more fulfilling than you ever imagined.

Disclaimer: This article is for informational and educational purposes only. It is not intended to be a substitute for professional financial, legal, or medical advice. Laws, regulations, and financial requirements related to international retirement change frequently. Please consult with qualified professionals before making any life-altering decisions.