The 2024 Social Security tax wage base increases this year! Let’s find out more!

New year, new money resolutions, and new Social Security information. On January 1, a couple of 2024 Social Security changes went into effect, which impact what beneficiaries receive and how they become eligible.

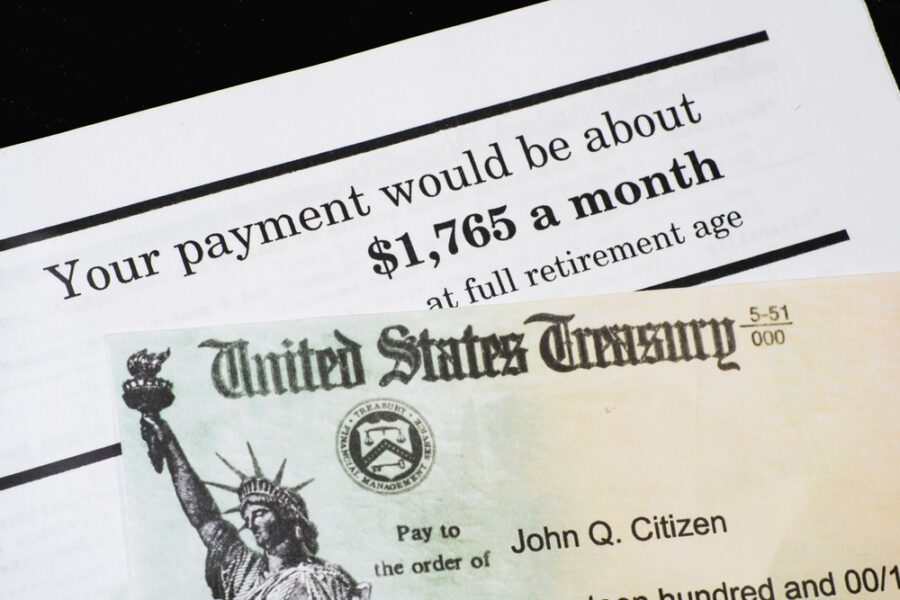

If you’re a beneficiary or are planning to apply in 2024, there are several key changes to be aware of. One, and perhaps the most important one for most recipients, is the increase in monthly benefits.

Our article is here to keep you up to date, so here’s what you should know about 2024 Social Security!

The COLA for 2024

Every year, the Social Security Administration institutes a cost-of-living adjustment, also known as COLA, so beneficiaries can keep up with costs. By law, it takes into effect the percent change between the average price in the third quarter of the previous year and the third quarter of the current year.

The reason the fourth quarter isn’t taken into consideration is because the number is usually not available from the US Bureau of Labor Statistics until mid-January, and the Social Security Administration needs to make its adjustment on January 1.

The COLA for 2024 is 3.2%, which means recipients will see their monthly benefits rise by that amount for this year. According to the SSA, 71 million beneficiaries will benefit from the increase. The average monthly check for a single retired worker will be raised to $1,907, up $59 from $1,827 in 2023, and for a retired couple both getting benefits to $3,033, up $94 from $2,939 in 2023.

It’s worth mentioning that this is a small boost compared to the 8.7% COLA for 2023 (the largest since 1981) and shows the damper that’s been put on inflation.

You may wonder when you will start getting the increase. The COLA goes into effect on January 1. The new COLA for Supplemental Security Income (SSI) beneficiaries started on December 29, 2023, as January 1 is a holiday.

In terms of when exactly you get your payment, it depends on the date of your birth, based on 2024 Social Security’s regular payment schedule. Usually, if your birthday is the 1st through 10th day of its respective month, you’ll receive your money on the second Wednesday of the month.

If the date of your birth is the 11th through the 20th of the month, you’ll receive your payment on the third Wednesday. And if your birthday is after the 20th of the month, you’ll get paid on the fourth Wednesday.

By the way, if you want to learn more about Social Security, this book might help!

2024 Social Security taxes are rising

Some wealthy taxpayers may see higher taxes this year, as the 2024 Social Security tax wage base is rising by 5.2%.

This being said, this year’s wage base will be $168,600, going up from $160,200. This means you won’t have to pay Social Security payroll tax on the amount exceeding $168,600 you earn.

According to financial experts, the maximum 2024 Social Security tax is jumping from $9,932 to $10,453. In other words, people making more than $168,600 this year will be paying around $521 more in Social Security taxes the following year than they would have paid if the wage base stayed at $160,200.

This adjustment for 2024 Social Security basically means higher taxes for around 6% of workers and is based on changes in the national average wage index. Keep in mind that these taxes fund the Social Security program, which provides retirement, survivor, and disability benefits to eligible beneficiaries.

Who is exempt from the Social Security tax?

Some people don’t have to pay Social Security taxes. It’s important to note that exemptions from these taxes may be available if certain conditions are met. Some examples are listed below, but don’t forget that other exemptions may be available.

This being said, those who don’t have to pay Social Security taxes are students and certain young (minor) workers, certain members of religious groups or organizations, people the IRS considers to be “non-resident aliens,” and employees of foreign governments.

The maximum benefit

The actual maximum benefit goes up and down depending on the age at which you claim. For instance, someone who was born in early 1958 will reach their full retirement age of 66 and 8 months in late 2024. But we’ll talk about 2024 Social Security qualifiers a bit later.

However, if they wait until age 70 to claim, their monthly payments will be 27% higher. Also known as “delayed retirement credit,” it equals two-thirds of 1% per month for each month of delay, or 8% a year.

It’s important to keep in mind that there’s no advantage to waiting beyond 70. Also, those who wait past full retirement age to sign up for retirement benefits don’t lose the benefit of yearly COLAs; instead, the yearly COLA is meant to adjust a beneficiary’s benefit at full retirement age before it’s multiplied by the delayed retirement credit.

Who qualifies for 2024 Social Security? Let’s find out!

Some 2024 Social Security qualifiers

There are two checkpoints to remember for 2024: the full retirement age and the earnings test.

Let’s start with the first one. If this year is when you’re planning to apply for Social Security retirement benefits, be aware of the full retirement age rules. As we’ve mentioned above, you can start getting benefits as soon as age 62, but you only qualify for full benefits when you reach the full retirement age, which is determined by the year you were born.

As you already know, if someone was born in 1957, they reach their FRA at 66 years and 6 months. For those who were born in 1958, they reach full retirement age at 66 years and 8 months, so they have to wait two months longer than if they were born in 1957.

Now, let’s talk about the 2024 Social Security earnings test. This applies if you’re below the full retirement age and still working and earning income while receiving retirement benefits (it’s also one of the reasons many personal finance experts suggest waiting until the full retirement age to collect).

Basically, if you’re making above a set amount, the SSA will withhold $1 for each $2 above that amount. The 2024 Social Security earning test limit is $22,320, up from $21,240 in 2023.

Keep in mind that it’s just being withheld—when you reach your full retirement age, your checks will contain the withholdings. Also, remember that it only accounts for income from work; investment income, for instance, and retirement plan payouts don’t count for the earnings test.

Qualifying for benefits

You qualify for retirement benefits by collecting Social Security credits, which you receive by doing “covered” work—a job or self-employment in which you pay taxes on your income. In 2024, you receive one credit for earnings of $1,730, which is $90 more than the 2023 level.

You can collect up to four credits per year, equivalent to $6,920 in work income in 2024. You need 40 credits, or 10 years of covered work, to become eligible for retirement benefits (the 10 years don’t need to be consecutive).

You must also collect credits to qualify for SSDI, but the total number necessary can range from six (for a year and a half of work) to 40, depending on your age when a medical condition sidelines you from work.

If you liked our article on how 2024 Social Security will look, you may also want to read Shocking New Tax Changes Coming Up in 2024.

I am 72, i starting collecting my full social security when i was 65 and half. I was born 1952. I went back to work, and they still take out social security out of my check. When i call the social security office and asked them where is my funds going since all ready retired. They did not know, but said it was legal. Although my retirement check was not increased. Do anyone know what happens to that money being taken out?

This information is very helpful and helps you to decide on what steps to take.