How to spot online scams

Let’s talk about the most common online senior fraud scams:

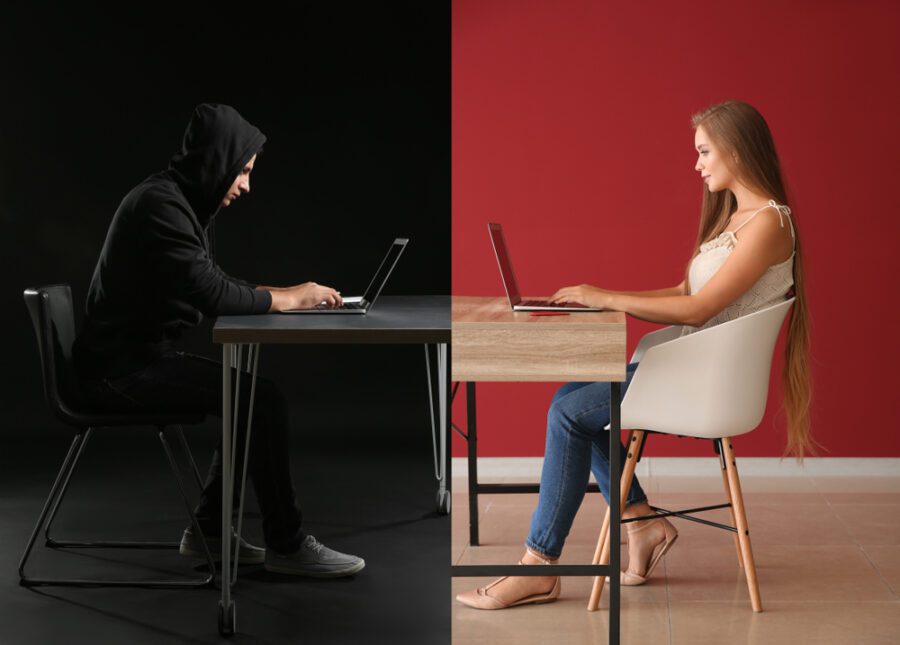

- Romance scams: Criminals might try to pose as interested romantic partners to exploit you for money. They will usually find you on various dating websites or even on social media.

- Charity and lottery scams: Sometimes, scammers pretend to represent legitimate charities, lotteries, or even sweepstakes, trying to convince you that you won a contest or pressuring you into donating money.

- Tech support scams: Criminals might contact you through tech support and try to flag a mobile device issue that doesn’t exist. They will come up with a solution to the so-called “problem” by using a program or device meant to steal your personal information.

- Grandchild scams: Sometimes, criminals pretend to be your grandchildren and ask you for financial help. In these cases, they will give you only a few seconds to process the information, claiming that your grandchildren are in serious danger and need your help immediately.

- “Government calls” scams: Scammers could also pretend to be government employees, demanding payment and personal information such as taxes, Social Security numbers, or even pensions.

In most cases, online scammers are incredibly persistent, and they will demand that you act as quickly as possible. It could be related to anything, from allowing access to your device to giving away private information to even sending some money.

It’s highly important for you to resist that pressure and take the time needed to assess the situation in the right way. If you’ve never dealt with this issue before, here are some basic tips you need to know in order to determine whether or not you’re discussing it with a legitimate person:

- Don’t click or download anything. If you have the slightest suspicion about a certain message or call, don’t click on anything. It only takes one unsafe link or file to steal all your data, cause damage to your devices, and do many other things. If you need external help, you could get one of the best internet security software programs, Norton, because it will automatically block unsafe links and suspicious downloads in real time.

- Go directly to the source. You could always google the charity, lottery, tech department, or government office that’s claiming to contact you. You could also contact these organizations and verify if a scammer or a real person contacted you.

- Ask yourself a couple of clarifying questions. You could always ask yourself why anyone from tech support would ask you to download a file. Because if you think about it, it doesn’t really make sense, and it will only expose whether or not the message comes from a legitimate source or not.

- Use Google. Luckily for us, most scammers don’t spend too much time on creativity, so there’s a high chance others got scammed in the same way. You could always copy and paste the message in that fishy email or text message and Google it with the word “scam” at the end of it. See if someone else received a similar text or not.