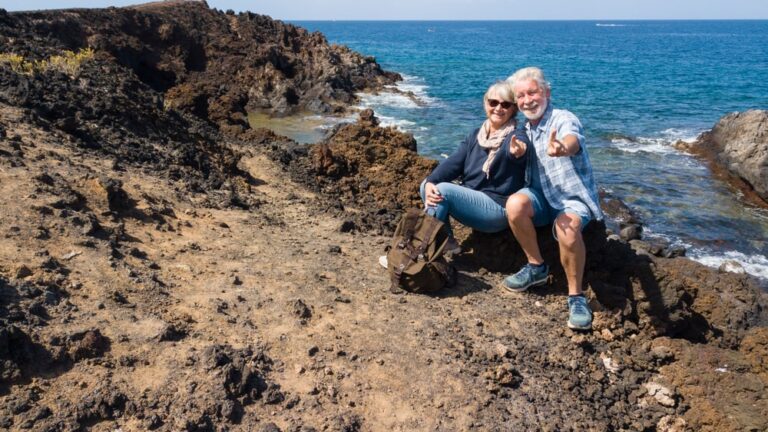

Other financial benefits or working in retirement

Besides increasing Social Security benefits, retirement gigs can also help cover essential expenses. This decision can help you pay for essential expenses such as food, utilities, housing, and health care without using retirement savings. This could allow you to invest more in your savings and enable more “lifestyle” spending.

Retirement gigs can also grow your savings. If your employer provides you with a 401(k) plan and you qualify to enroll, you can contribute up to $22,500 plus an extra $7,500 in catch-up contributions for 2023 (this only applies to those age 50 and older). If you own a deferred annuity, you can continue to set it aside after you reach your IRA or 401(k) annual contribution limit.

Finally, retirement gigs provide flexibility with the amount of savings you spend every year. Aspects such as interest rates, health care, inflation, risk tolerance, and market volatility affect the percentage of savings you can sustainably use during your golden years (i.e., your withdrawal rate). Working after full retirement age can offset these factors to make your savings last.

You may also want to read 12 GOOD Side Jobs for Seniors Living in a Small Town.