Making an isolated decision

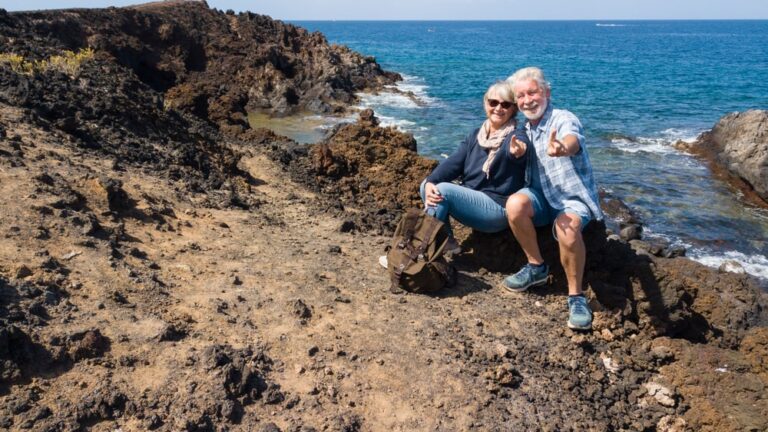

According to Charlie Bolognino, a certified financial planner at Side-by-Side Financial Planning in Plymouth, Minnesota, deciding on your Social Security is just a piece of the whole retirement income puzzle.

But did you know that it has a great impact on the way you draw down other retirement income sources, like a pension, 401(k) plan, or even your cash savings? It might also affect the amount of retirement income you might lose to federal or state taxes.

If you decide not to take into consideration any of these retirement funding factors when you act upon a Social Security decision, might prove to be a disaster and cost you a lot of money from your nest egg.

“This is a huge decision that could potentially cost you thousands of dollars, so it’s highly recommended you don’t short-cut it.” as Bolognino advised. ” Try finding a reputable benefit option comparison tool, or even work with a financial planner who is able to help you evaluate your options in the context of a bigger financial picture.”

1 thought on “7 Social Security Mistakes That Could Cost You a Fortune”

Cash is king always try to pay for something in person with that there will be no discrepancy about whether the funds are available or not.